Smsf audit program

The documentation requirements of the standards are exhaustive. It is vitally important that each audit file can stand alone and support both compliance with the. Let us be your competitive advantage. Want to find out more? All toolkit documents are updated as require ensuring your office stays up to speed with all ATO audit requirements.

The program can save substantial time to plan and document that process. We have a tax specialist on our staff who can prepare and lodge private ruling requests for you or your clients and who can assist with any ATO tax review or audit. We provide complying, timely audits and offer support to solve potential problems.

Audit documentation. A data feed is a stream of data directly from the source, to a software program or platform. Why is this so important?

Create the required Australian Taxation Office reports and Fund reports. To audit a self-managed super fun an auditor must be a qualified member of an approved professional organisation. Our audit files may, however, be subject to review as part of the compliance program of a professional accounting body or the Australian Taxation Office. We advise you that by signing this letter you acknowledge that, if requeste our audit files relating to this audit will be made available under these programs.

SMSF – Approval no. A compliance audit involves performing audit procedures to obtain audit evidence about the Fund’s compliance with the provisions of the SISA and SISR specified in the Australian Taxation Office’s approved form auditor’s report. Our standard turnaround time is usually very quick. An approved ATO course of education for education direction purposes, the Self-Managed Superannuation Funds Trustee Education Program is designed to help trustees in understanding their role and responsibilities. Includes pre-exam education component.

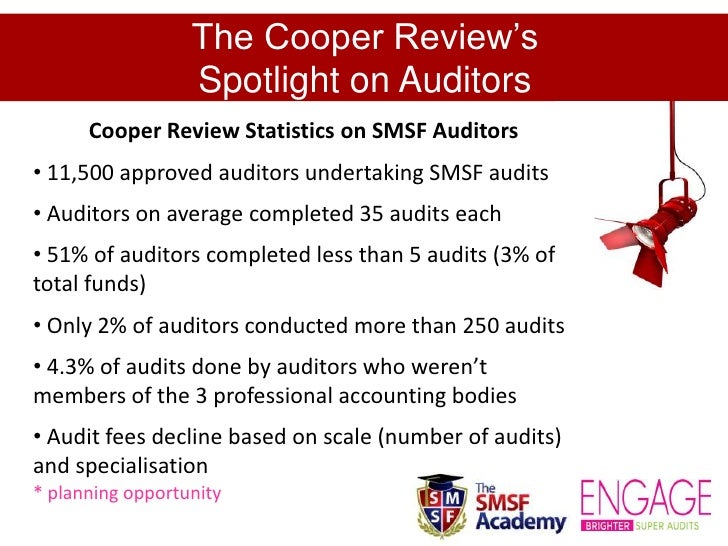

Statistics from the ATO here. Technology driven, we designed a cutting edge online platform to help organise and receive your files. Our in-house audit program captures comprehensive data of the fund and automatically highlights all potential risk areas. ABOUT THIS PROGRAM.

Program focuses on the Legislative Framework governing audits. We have successfully passed our Quality Assurance Review from CPA Australia. We will also explore reciprocal arrangements and look into the commercial implications for accounting practices. A history of timely submissions (SAR).

Recently the ATO have taken steps to enforce this requirement on a number of practitioners. They must also accept the auditor’s findings when contravention reports are lodged with the ATO. Thanks for your patience whilst we checked some information with a specialist area. They must report any non-compliance issues to all fund trustees and the ATO. Our service is fully compliant with professional standards.

The nature and type of targeted internal audit and risk activity should both ensure (protect) and enhance (create) your value. Our mission is to provide high quality, prompt, reliable, efficient and cost-effective services to small and medium-sized accounting firms, administrators, financial planners and trustees locally and Australia wide.

Comments

Post a Comment