Ird number application trust

Auckland Family Trust Lawyer, Do You Need An IRD Number ? Non-resident GST business claimants will need to use the Non-resident GST business claimant registration (IR564) form. IRD number application - non-individual - IR596. With your visa from Immigration NZ, there will be wording around an arrival date. This is the date by which you must arrive in New Zealand. You can register any branch or division separately through myIR Secure Online Services.

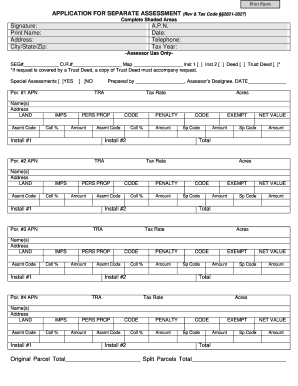

Applications are processed in real time and in most cases you’ll receive immediate confirmation of the GST number and registration details. If the trust has any Inheritance Tax to pay, you must apply for a separate reference number by completing form IHT122. You must complete this weeks before any payment is made.

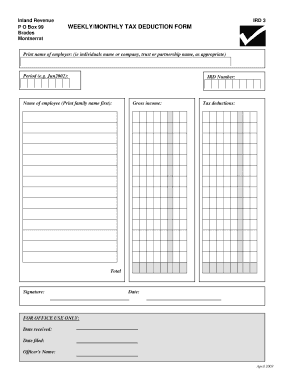

This includes non-income generating family trusts that own the main family home. However, the processing time may well increase as the volume of applications grow? Please answer all questions and sign the declaration. Continue on a separate sheet if necessary.

Election to pay income tax on trustee income - IR463. Use this form to elect to pay income tax on the trustee income of foreign or non-qualifying trusts. Making this election means that the trust becomes a qualifying trust.

Estate or trust return notes and worksheet IR6N. If you’re starting an organisation that will involve money changing hands, it’ll need. Providing these documents will speed up the process. A trust is a way of managing assets (money, investments, land or buildings) for people - types of trust , how they are taxe where to get help Trusts and taxes: Trustees - tax responsibilities.

If you need an EIN for your living trust , you can complete and submit a paper Application for Employer Identification Number (Form SS-4). If you mail the form to the IRS, you should receive it within four weeks. You can also fax the application to the IRS, in which case you should receive it by return fax within four days. This can take several weeks to be processed. The application form can be found on the IRD website.

The content of this article is intended to provide a general guide to the subject matter. The IRS uses unique numbers to identify and track businesses and trusts. It’s important to apply for an irrevocable trust tax ID number as soon as possible to simplify tax filing, asset management, and financial transactions. IRS EIN Tax ID Filing Service makes it simple to apply for your tax ID number.

Print the full name of the organisation 2. Is this application for a branch? Start your application for a trust tax ID number or, if you’re acting as an estate executor, an estate tax ID number. A revocable living trust does not typically need its own Tax Identification Number (TIN) while the grantor is still alive. Call HMRC for help with queries about how trusts are taxed.

This must happen before the trustee change can be registered in Landonline. Company, Partnership, Trust or other Body of Persons. To : The Hong Kong Competent Authority.

Comments

Post a Comment